Diamonds represent one of the world’s most valuable and sought after natural resources. The global retail value of diamond jewelry is estimated to be $72 B, with an average of 130 M carats of raw diamonds being produced annually. Prior to 1867, however, diamonds could only be found in Brazil or India, or on the hands of the wealthy elite, and annual gem diamond production amounted to little more than a few pounds.

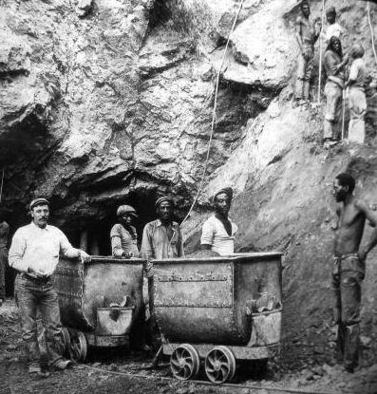

http://www.miningartifacts.org/South-African-Mines.html

The nature of the diamond trade changed drastically following the discovery of diamonds in South Africa and the ensuing mining mania, which mirrored the California Gold Rush of 1849. The De Beers Mining Company, founded by Cecil Rhodes in 1870, emerged victorious from this frenzy and established a monopoly that would dominate the industry for decades to come; by 1887, De Beers was the sole owner of South African diamond mines.

The De Beers monopoly was built upon supply control. In order to regulate the supply of diamonds into the market, De Beers took control of distribution channels and formed the Central Selling Organization (CSO), which functioned as the company’s marketing apparatus and controlled around 90 percent of the world’s diamonds. CSO suppliers, eager to sell their stones, were forced to sign an exclusivity agreement that prevented them from forming outside contracts with other distributors.

With the CSO in place, the De Beers conglomerate functioned as follows: De Beers determines the amount of diamonds that it plans to sell in a given year. Each producer is promised a fixed percentage of this total quantity, meaning De Beers pledges to buy that portion of diamonds from the producer and bring them to market through the CSO. Once the number is set, a subsidiary of De Beers purchases diamonds from all producers, including De Beers own mining operations. De Beers then sells the diamonds to dealers via the CSO and charges producers a handling and marketing fee. To prevent price decrease, De Beers purchases any excess supply of diamonds in the market and stores them in its infamous vaults.

The ability of the De Beers cartel to control prices was threatened by economic depression and outside actors. When inflation was high or the stock market was suffering in a given country, investors would capitalize on the stability of diamond prices by holding large quantities of the gem. De Beers faced the threat of a market flooding if these investors were to engage in a mass sell-off.

Additionally, as has been noted in previous blog posts, cartel members are always haunted by the prospect of profits that could be made outside of the fixed arrangement. In 1957, Russia entered the picture following the discovery of large quantities of diamonds in Siberia. De Beers recognized the threat and struck a deal with the Soviet government to purchase 95 percent of Russia’s annual rough diamond output at a 10-20 percent premium, thus ensuring that all Russian diamonds could be properly channeled through the CSO. Following the collapse of the Soviet Union, Russia was in a state of economic decline and sensed the substantial revenue increase it could realize were it to take its diamonds straight to market. In 1984, Russia broke from the cartel and flooded the Antwerp clearing house with polished diamonds. As a result, De Beers experienced a sharp decline in profits, and other suppliers threatened to follow in Russia’s footsteps.

Although De Beers was eventually able to renegotiate with Russia under new terms, the integrity of the monopoly had been compromised as the power had swayed in favor of the producer. By the 1990’s, several new sources of diamonds had emerged and De Beers could no longer maintain near-complete control of the diamond trade.

In 2013, for the first time in 100 years, market forces were recognized as the driver of diamond prices, not monopolistic behavior. De Beers now controls only 35 percent of the world’s diamonds, compared to 90 percent for most of the 20th century, and the company posted a 45 percent decrease in operating profit in 2015.

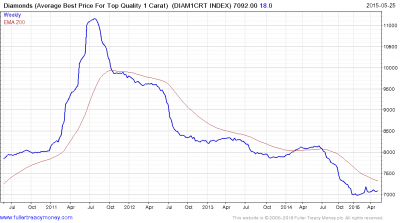

http://roughdiamondbuyers.com/?tag=rough-diamond-prices

To keep profits from falling each year, major producers rely on demand driving ad campaigns instead of supply controlling market manipulation. The diamond industry has shifted its focus away from the U.S. and Europe and onto the newly minted upper classes of China and India.

Despite the industry’s best efforts, diamond prices fell roughly 15 percent in 2015 and threaten to continue on the recent downward trend. Moving forward, the industry will either have to penetrate new markets or come to terms with the shrinking size of its consumer base.

Sources

Biesheuvel, Thomas. “Diamonds’ Former Monopolist Bows to Market Forces to Spur Demand.” Bloomberg Business. Bloomberg, 8 Sept. 2015. Web.

Epstein, Edward J. “Have You Ever Tried To Sell a Diamond?” The Atlantic. Atlantic Media Company, 1982. Web.

Goldschein, Eric. “The Incredible Story Of How De Beers Created And Lost The Most Powerful Monopoly Ever.” Business Insider. Business Insider Inc., 19 Dec. 2011. Web.

Kuo, Lily. “De Beers (and the Entire Diamond Industry) Pins Its Hopes on China and India.” Quartz. Atlantic Media Company, 18 Feb. 2013. Web.

Kretschmer, Tobias. “DeBeers and Beyond: The History of the International Diamond Cartel.” New York University Online. London Business School, 1988. Web.

O’Connell, Patricia. “The Issue: De Beers’ Multifaceted Strategy Shift.” Bloomberg Business. Bloomberg, 6 Jan. 2009. Web.

Zimnisky, Paul. “Diamonds: Driven by Market Forces for the First Time in 100 Years.” ResourceInvestor.com. 9 Apr. 2013. Web.

8 Comments

This is an interesting overview of the history and evolution of the diamond industry. I recall an earlier blog post that focused on the successful and still relevant 1947 De Beers Mining Company’s marketing campaign. It is interesting that the company had been around for almost 100 years before the successful campaign. Furthermore, 10 years after the campaign aired, the company faced a huge hurdle with Russia’s diamond discovery. Despite the 10-20% premium, I am surprised that Russia was willing to negotiate with De Beers Company. Fast forwarding to 2015, more diamonds are on the market and prices are declining. Perhaps consumers are now wanting practicality and remembering what they knew before the De Beers’ 1947 marketing campaign: diamonds are just rocks.

The post mentioned the diamond industry is shifting its focus onto China, but in fact the Chinese economy has been facing a huge commodity slump in recent years and the demand for diamond in Asian markets has been lower than expected. Interestingly, De Beers has been claiming that the market is strong and “it’s business as usual” while it really is not. An article from Bloomberg shows that in 2015, De Beers announced a “major” investment in order to sell diamonds in the U.S. and China in August despite the weakened demand in both markets.

Source: http://www.bloomberg.com/news/articles/2015-10-20/diamond-industry-dragged-into-slump-as-china-demand-ebbs-away

Your closing paragraphs suggested that the market for diamonds is shifting to the upper-classes of India and China, but you stated that the industry may have to understand their market is shrinking? I would be interested to see how the markets for diamond consumers in India and China differ from previous U.S. consumers. The upper-classes of India and China probably have disposable income equivalent to the median U.S. household, but given the sheer differences in size of these two countries is it possible that the industry can experience more profits when selling to these new consumers? At the very least I would imagine that, as you stated, “newly minted” upper-class members of these countries would want to purchase diamonds as well as other staples of luxury.

– By Andrew Donchez

Andrew, even if these new consumers aren’t more profitable in and of themselves, doesn’t figuring out how to tap this market, how to create the “diamonds are forever mindset”, work quite nicely by shifting the demand curve out?

Looking further at the relationship between Russia and De Beers, it seems as if we might soon again see some tension between the two diamond suppliers. As I noted in my earlier blog post, budget deficits are forcing Russia to take a long look at Gazprom’s natural gas export monopoly, but diamond supply is also now getting into the fray–as the Russian government plans to sell over 160,000 carats of stones. Interestingly, the government came to control these stones in the wake of the recession, when it had to bail out mining monopolist Alrosa, who as it turns out was only free from De Beers’s reigns due to an EU court ruling that broke up the two’s longstanding cartel/price controlling relationship (the relationship noted in the above post). Now, it is selling its reserves as a desperate attempt to cover some of its massive deficit. As far as global price changes, Tyler Durden of Zero Hedge contends that while global prices may not change in the short run because of Russia’s dump, it seems likely that the move will likely further push diamond prices – which are at unprecedented lows – further into the pits over the long run.

Source:

http://www.zerohedge.com/news/2016-02-15/russia-set-flood-diamond-market-firesale-167500-carats

Cartels create an incentive for new entry; unstable demand makes it hard to distinguish cheating from an unanticipated drop in demand that meant planned sales didn’t keep prices stable, even though corporate planning thought they amount they’d sell wouldn’t depress prices.

So … will we see a price war? and if prices collapse, would you really want to spend a lot on a diamond that might be an exclusive bauble today but just another piece of jewelry tomorrow? If that’s the fear, wouldn’t you search for something more exclusive for that lady you’ve been courting (and lead ladies to expect something nicer than a dime-a-dozen diamond)?

After a period where diamond prices fell, De Beers is now starting to raise the price again (source: http://www.bloomberg.com/news/articles/2016-04-06/de-beers-said-to-raise-diamond-prices-for-first-time-since-2014). While it’s still too early to say if the industry will recover and regain its previous strength, this could be the first sign. It will be interesting to see how diamond prices fluctuate over the next few months.

Comments are closed.