Almost a year ago, Charter Communications announced that it would be buying Time Warner Cable for $55 billion dollars. The United States’ government, however, has still not approved the merger and Charter has experienced a large amount of public opposition to this merger due to the large portion of the market share that they will receive if the merger succeeds.

Almost a year ago, Charter Communications announced that it would be buying Time Warner Cable for $55 billion dollars. The United States’ government, however, has still not approved the merger and Charter has experienced a large amount of public opposition to this merger due to the large portion of the market share that they will receive if the merger succeeds.

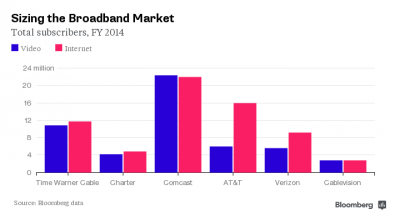

The real concern for the American consumer should be how this merger could potentially affect the market. While it is unlikely that there will ever be a true monopoly in the broadband industry, which provides high-speed internet and cable services, the merger would essentially create a duopoly in the industry. If the merger succeeds Charter Communications would become the second largest cable provider in the United States, holding 23% of the market. They would only follow Comcast who currently holds 47.6% of the market. While neither company would alone hold a majority of the market, the concern becomes their ability to coordinate prices and control over the online video market, which would lead them to essentially act as a monopoly within the market. Their ability to act as a duopoly would be furthered by the innate characteristics of a cable company, which requires large amounts of money, large scales of production, and efficiency in order to provide consumers with a quality experience.

If passed, not only is the cable industry likely to turn into a duopoly, this could have drastic effects on the market. First Charter Communications and Comcast could use their internet service market power in order to determine at what price and what content consumers have access to. Additionally, they could attempt to increase the price of online video providers, such as Netflix, by adding data caps that would increase the user’s overall price. Lastly, they may restrict which online video providers could be watched through their set-top box. While there are other set-top boxes, such as Apple T.V. or Xbox, that can provide this service, these act as an additional cost to the consumer. Therefore, some American households may only be able to afford their cable providers set-top box.

However, Americans may not need to worry quite yet because the chances of this merger passing are not looking good. President Obama, the FCC Chairman Tom Wheeler, Dish Network, USTelecom, and Public Knowledge have all publicly spoken out in opposition of the merger. Only time will tell, but if the merger is passed we could be experiencing some major price changes in both cable and online video providers in the years to come.

Sources:

http://variety.com/2016/biz/news/charter-time-warner-cable-merger-dish-network-1201684570/

http://fortune.com/2016/04/02/bezos-blue-origin-success/

http://variety.com/2016/biz/news/charter-time-warner-cable-merger-dish-network-1201684570

9 Comments

This is a really interesting topic that hasn’t received much attention in the news. According to this article (link below), Charter has agreed to “increase broadband speeds, expand network access in low-income communities and improve customer service” in part of an agreement that allowed this merger to stay afloat. Despite this, California remains the only state now to have not approved of this merger. I think at this point it is likely Charter/TWC will win this battle and be allowed to merge. It will perhaps be more interesting to see if this helps or hurts the average consumer.

http://www.bloomberg.com/news/articles/2016-03-09/new-york-city-approves-time-warner-cable-charter-merger

We need to place this in the context of larger changes in TV markets. We have broadcast (now digital so higher in quality), cable, satellite, and internet delivery (both ASDL and fiber optic), with G4 cell phone delivery increasing on the margin. So this may be similar to beer: in a shrinking market, consolidation is less of a worry?

I agree with the above comment – I rarely consume media through cable television anymore. When I choose to watch television programs or a movie, I do so through Netflix, Hulu or some other streaming service – and almost always on my computer instead of my home television. So does consolidation really matter in this shrinking market? I don’t think so. Further, cable providers are often geographic – I have Comcast at home, my sister in Georgia has Charter, my friend in California has TWC. So the notion of choosing between providers is not of paramount importance here. The primary concern I have is if a major merger capped data. That would have monumental impacts on the changing market, especially because my generation is so reliant and dependent upon data streaming.

Your comment about television streaming brings up questions about the economic effects of online/box (Roku, Apple TV, Amazon Firestick, WatchESPN, etc.) streaming. If these platforms really are the future of TV, then this merger could make sense in order to consolidate the two cable providers as they move forward competing with these newer platforms. However, when I think of sports television, often times even with streaming online one will need a cable provider account to access streams. How/will individual channels like ESPN adjust out of the cable provider framework? Is it legally viable at this point due to contracts?

Also, with cable providers, the issue of bundling arises – bundle internet, home phone, and cable to receive a discounted price. But home phones are too falling by the wayside to cell phones, so this cable provider practice may in and of itself also become an unviable option in the coming years. The last peg to fall, and one that I really don’t know much about, is internet service (Wi-Fi). Do options for alternative internet already exist?

Your comment about ESPN and their future interested me because I recently read about their large subscription loss. ESPN has lost 7.2 million subscribers in the past four years and 3 million in just the past year. Why is this a problem? When you buy a cable bundle the bill shows as one amount, but you actually pay for every single channel even though you hardly use any of them. ESPN costs the most at almost 7 dollars a month which is much higher than the second most expensive channel. This is a huge problem because the number of people who are cord cutting is accelerating. ESPN mainly uses the revenue it brings in to pay associations and leagues for network rights, but with the number of people no longer subscribing they could be in big trouble.

Source:

http://www.foxsports.com/college-football/outkick-the-coverage/is-espn-a-giant-bubble-about-to-burst-071215

Your comment about the various cable/internet providers used by your friends and relatives touches on an important aspect of this deal – as it stands, the three companies (Charter, TWC, Bright House – which is involved but not mentioned in the post) do not have any service area overlap. TWC covers a lot of the east coast and also has NYC and LA; Charter covers complementary areas of the U.S.; Bright House is mainly in Florida. So if the deal goes through, the type of choosing between providers you mentioned as not being important might not even be a possibility.

http://qz.com/411712/the-charts-and-maps-you-need-to-understand-why-charter-is-buying-time-warner-cable-and-bright-house/

There have been a number of big mergers fall apart in the past twelve months. In the pharmaceutical industry, Pfizer and Allergan were unable to negotiate a successful deal. In the energy industry, a deal between Halliburton and Baker Hughes is beginning to look unlikely, and the deal between Williams Company and Energy Transfer Partners has run into headwinds. Different industry, obviously, are subjugated to different variables, but it will be interesting to follow if a deal of this magnitude can successfully travel down the pipeline.

Very interesting post. The question I have is what is the precedent in the market already for mergers such as this one? What mergers have already occurred and what were the results seen in the market following those mergers?

This reminds of what’s happening right now in the hotel industry – the potential merger of Starwood and Marriott and whether that’s allowed under the antitrust laws.

Comments are closed.