In Japan, motor vehicles were few and far between in the 1950s, and in 1956 half of all vehicles produced were still 3-wheelers. Car production surpassed that of trucks only in 1969, and it was only from the mid-1970s that there were more cars than trucks on the road. Even in 1985 there were only 711,000 full-sized cars on the road. It was not a big market for higher-end vehicles.

But a November 22nd Bloomberg story on the (to date) counterproductive outcomes of the “China 2025” industrial policy leads me to address a different set up issues, whether automotive industrial policy makes sense. To do I switch back and forth from automotive historian mode to economic analysis.

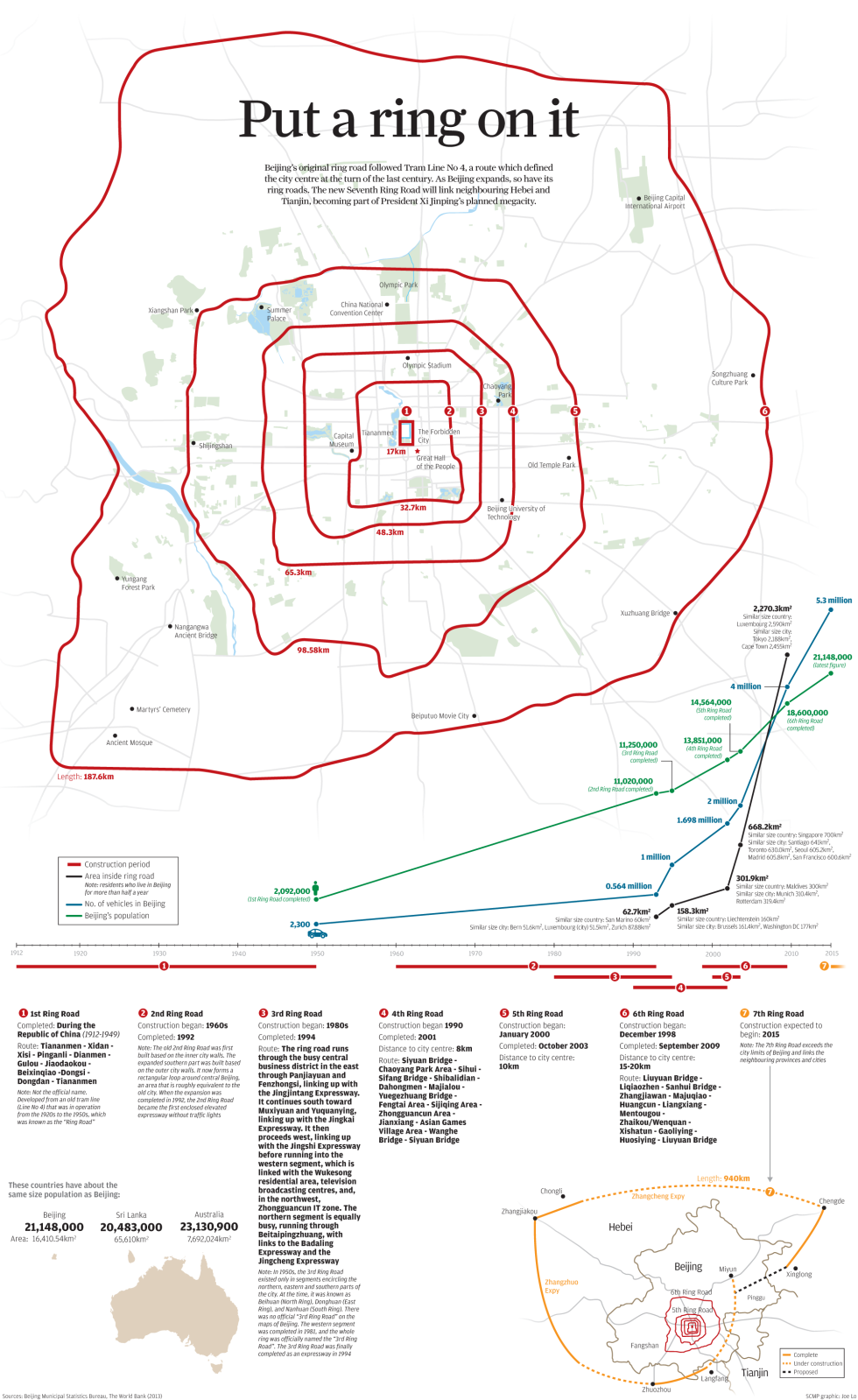

In Japan, promoting the auto industry via import substitution industrialization was costly. That’s one reason that there were so few vehicles on the road. Industrial policy imposed a cost not just on vehicle users, but on everyone who relied on logistics – which was, of course, everyone. And because there were so few vehicles, the postwar plans for highways and local roads got moved to the back burner. The Yokohama ring road was laid out in 1950, but completed only in 2005. The outer Tokyo ring was planned back in 1927, but not completed until 1985, and at only 4 lanes. The last segment of the inner portion wasn’t completed until 2015. Some of the connecting roads and junctions are still under construction. (In Chinese, ring road is huánlù 环路; in Japanese, 環状線 kanjousen.)

Of course there’s the contribution to the domestic economy. If it’s being subsidized, through policies that allowed firms to charge prices far above international levels, then the contribution of that industry is smaller than that of non-subsidized sectors of the economy. That’s made worse in this case by the negative externalities of costly logistics. The Japanese domestic auto industry likely wasn’t competitive in the subcompact segment until the mid-1970s, and from then on could survive without subsidies. But competitive full-sized cars came even later. BMW made a fortune in the 1980s and 1990s in Japan because they could charge higher prices than in other global markets, suggesting that the Japanese producers weren’t competitive in that segment until the 1990s, and (given branding) perhaps not even until 2006, when Toyota at last launched their “German-killer” Lexus marque inside Japan. While Japan removed formal trade barriers by 1971, Japan’s domestic market was small. The preferred route for the Detroit Three was via acquisitions, not de novo “greenfield” plants or exports (which would have been compact cars from Europe, not large cars from the US).

Trade models don’t show that subsidizing industries saves on foreign exchange, because (cf. expensive domestic transport above) it raises costs for exporters and for firms that face import competition. Japan’s surge in exports to the US following the 2nd oil crisis was brief, as the market for subcompacts collapsed by the mid-1980s. But in the meantime the US formally subsidized direct foreign investment (via the VER, voluntary export restraint, imposed by the Reagan Administration in May 1981) and encouraged imports (a side effect of the strong dollar policy of the early 1980s, one of the channels through which high interest rates helped quell inflation).

So I don’t think that “It would have been self-defeating not to support MITI’s policy to nurture – and protect – Japan’s infant auto industry.” (citing Roger Schreffler, of Wards Automotive, arguing on the NBR Japan Forum about US policy towards Japan in the Cold War.) It would have made more sense in the 1950s to welcome imports, and particularly to welcome direct foreign investment. The industry would have been more efficient early on, to the benefit of the growth of the economy as a whole. Through 1967 Japan faced periodic balance-of-payments crises, including a trip to the IMF in 1961, but by 1969 foreign exchange reserves were robust for the first time in the post-WWII era, while 15 years of rapid growth had raised incomes and automotive sales – it was only in 1967 that passenger cars first outsold commercial vehicles. Policy was to open the industry up to trade – while a grad student some decades back I read through many contemporary Japanese sources, where the need increase competitiveness was touted year in and year out, even while agriculture was fenced off from such pressures. It didn’t hurt that there were several large car producers, and several that failed – when everyone was lowering costs, it was improve or die. Toyota did the former better than anyone else, for regular cars, while Suzuki was the undisputed champ for minicars (in Japanese, “kei” cars or 軽自動車 / 轻汽车).

China’s industry provides a case in point. The early industry began with a turnkey car factory built by Soviet engineers; it focused on trucks, but from 1955 made small numbers of cars so that the senior leadership could appear at public functions in a Chinese vehicle. A few joint ventures were allowed in the 1980s; that of VW in Shanghai did well, at one point accounting for 80% of all passenger cars made in China. The was also an Audi plant in Manchuria, which used an assembly line exported from a plant VW was closing in South Africa; that helped lay the groundwork for a black Audi becoming the vehicle of choice for Party officials. (There was also an engine JV of Mitsubishi Motors, which supplied truck plants throughout China.) Meanwhile protectionism allowed lots of inefficient assemblers to exist, at peak around 200 – in the 1950s Japan had 30 or so manufacturers, which wasn’t all that different given the 12-fold disparity in population.

In Japan those small, inefficient producers were whittled down in numbers, some through M&A (Toyota of the firms that became Kanto Jidosha and Toyota Auto Body, Nissan of Prince, 3 different Mitsubishi companies into Mitsubishi Motors), some via exit. But it took a long while for others to attain scale, and in 1980 there were still 8 passenger car makers (Toyota, Nissan, Honda, Subaru, Mitsubishi, Isuzu, Mazda, Daihatsu – did I forget one?).

China took a different route, touched off by the entry of GM in 2001, and a wave of subsequent ventures by the top global motor vehicle manufacturers (ditto agricultural and construction equipment firms). Motor vehicle prices fell rapidly, and continue to fall 17 years later. Exports? – not so much, because the economy grew so fast that the leading firms (the various joint ventures GM and VW) had no excess capacity, and as long as that was true, margins on sales within China remained more attractive than those on exports, which have to cover the costs of shipping and tariffs (2.5% for the US, now 10%). And they’ve worked on their road network, at the regional and the national level – unlike Japan, congestion isn’t for a lack of planning and effort.

So the bottom line is that import substitution industrialization was an utter and complete failure before 2001. Allowing global companies to dominate the industry has been a boon: high quality, lower cost “global” vehicles made with Chinese labor, and Chinese-made parts (every global supplier for which I’ve tracked down information, an ongoing research project, has a substantial presence in China). All of this now comes with increasing levels of local engineering, as local staff gain experience. So it’s a tale of two China’s, the worst of times under Japanese-style industrial policy, and the best of times when the market was opened.

There’s a bit of irony: China’s domestic market is slowing, so in an early 2017 book (Smitka and Warrian, $9.99 on Kindle) and in a January 2016 blog post, China’s Auto Industry Meltdown, I predicted excess capacity and exports within a couple years. Indeed, GM and Honda make niche products in China that are too low in likely sales to justify production in NAFTA, and had begun exports. Those have ended, at least to the US. A few “local” firms that aren’t doing well inside China do have excess capacity and exports – I rode in one such in Lima, Peru, but definitely a step up from a used car but a step down from the entry-level global products of Toyota (the Yaris) and Kia (the Rio). There’s no sign that China will manage to build significant levels of exports (through 2017 they’ve run a trade deficit on automotive products), because the most competitive firms – Toyota, Nissan, VW, GM, Hyundai-Kia – have local production bases around the world. But China remains a labor-abundant, capital-scarce economy for which the auto industry is still a weak fit. I’ve heard though that China does OK on the international trade front without the auto industry.

But how about electric vehicles, one focus of the Bloomberg article. They estimate that between them the national and provincial / local governments have spent $59 billion between 2009 and 2017. If you pay consumers enough they will buy them – Tomasso Pardi of ENS-Paris Saclav and Director of the GERPISA auto industry research association, together with Deng Xiaoxiang, analyzed insurance data on EVs in China. (Why insurance data? – you can’t use sales data due to the fraudulent registration of EVs by unscrupulous “manufacturers” to pocket subsidies.) They found that despite the equivalent of US $8,000 in direct subsidies from Beijing, in many provinces there were effectively zero sales. EVs sold only in cities that added their own cash subsidies – in Beijing, up to US$15,000 – and indirect subsidies (such as getting license plates immediately, while waiving the US$2500 license plate fee and the 10% sales tax). In Beijing, with a quota of 50,000 licenses, total sales of EVs were 58,000.

…from a selfish perspective, we should cheer China 2025 on…

Beijing’s China 2025 policy may sound great, but it can’t overcome the limitations of lithium electrochemistry that keep battery cell prices high. China does lead the global electric vehicle industry, not because they’re better, but because they have spent more. I’m guardedly optimistic that it is possible to develop better batteries. However, until scientists find ways are found to get around the current limitations, mass-market BEVs remain years down the road. Even if it’s Chinese labs that develop the core technologies, that won’t give the Chinese industry an advantage – second movers in the rest of the world will be able to improve on their chemical engineering. (No, that would not be stealing – you can’t patent basic science.)

So from a selfish perspective, we should cheer China on – let them be the ones to invest in creating global public goods. The more China 2025 money spent on battery R&D, the more likely improvements will come our way!

3 Comments

Li Yuan, a columnist for the New York Times, recognizes that the China 2025 policy has an very ambitious time table. She denotes that some Chinese modernization goals will likely come long after the year 2025. However, she states that the Chinese are pursuing this plan out of necessity. As with Japanese companies decades earlier, China recognizes that it must modernize or face bitter consequences. The push to modernize comes not only from Beijing alone. Many cities and businesses have bought into the plan, realizing the importance of modernization. Chinese businesses prioritize the growth of automation due to increasing labor costs, as some businesses have already moved to countries with lower labor costs due to wage increases. Hence, Chinese companies are increasingly investing in capital in lieu of human labor. Yuan does recognize that goals of the China 2025 policy including self-driving cars and advanced microchips remain ambiguous for now. That said, a joint pursuit in innovation between the Chinese government and Chinese businesses renders advancements in the automotive industry as far more palpable in the future than they otherwise would be. So China’s focus on R&D across fields could be advantageous for the nation despite the issue of other nations effectively acting as free riders. In creating global public goods, China can work in achieving its modernization plan, which it has deemed crucial, all while creating spillover benefits for other nations.

https://www.nytimes.com/2018/07/04/technology/made-in-china-2025-dongguan.html

Looking forward to the 2020’s, China role in the global automotive market is only projected to increase with special focus upon the burgeoning strength of its domestic Electric Vehicle manufacturing. KPMG reports indicate that the strength of the Chinese market, combined with political instability of Europe will realign global automotive manufacturing towards the China at the expense of current Western Europe production. Automotive executives praise China’s ability to introduce new car models and integrated communications infrastructure advances, which will allow China to stay at the forefront. Perhaps there are inherent inefficiencies to Chinese subsidiaries to the EV market, but it seems like the Chinese government is trying to overcome some institutional inertia from the automotive industry in developing these technologies. Electric vehicles are somewhat problematic in that it often seems like they are touted more highly as a social signifier than a practical solution to vehicular pollution, but the development of improved battery technology is extremely compelling. Perhaps the value of the automotive industry R&D will be the other applications that benefit from increased energy density.

https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2017/01/global-automotive-executive-survey-2017.pdf

While China and the United States account for over half of the worlds electric vehicles, the UK and France are targeting a ban of gas consuming vehicles by 2040. If they are successful, the UK and France will only sell (100%) electric vehicles within their borders. In addition, the EU is rumored to be considering a electric car mandate for their members. Competition is good for innovation, and it will be interesting to see which country or region is able to break the mold on electric vehicles and share their large success with the world. If any, what are the potential advantages to beating China in the advancement of global public goods such as electric vehicles?

Comments are closed.