Four weeks into his presidency, Donald Trump has made sweeping statements regarding the U.S.’s current economic standing with China, and that tensions arising from economic conflicts has left China prosperous, of course to the detriment of the American people. Trump’s rhetoric suggests China is an economic enemy of the U.S., operating under different regulations, working standards, and currency meant to take advantage of the two nations’ globalized partnership. The China that Trump suggests currently exists, though, has not existed for some time. The supposed ‘sweat shops’ that continue to surface as news stories slamming Apple or Nike, are isolated and are in no way representations of the current manufacturing industry in China. The race to the bottom in the manufacturing industry has actually begun to shift away from China. Factory worker wages are the highest they have ever been, costs continue to rise in Chinese manufacturing, and there are a number of firms that are looking elsewhere, even the US, for their facilities.

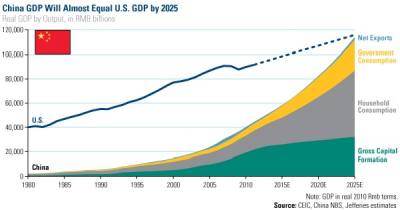

As for Sino-U.S. relations, they seem to be strong and getting stronger, regardless of the skepticism surrounding Trump’s foreign policy. A familiar debate has sparked in recent years over this relationship: does the U.S. need China more, or vice versa? Now that China has become an even more industrialized, globalized state since this topic was first debated in the 1980s, questions are being raised about the ability for the two nations to maintain a symbiotic relationship. What economists, politicians and scholars have found is that the U.S. and China have far more economic similarities than they do differences, and must focus on these similarities in order to evolve and expand as modernized states. This gap between economic goals will only continue to shrink as China takes a larger role in the global economy. One example is GDP growth, which in China has grown from one eighth the size of the U.S. to nearly two thirds.

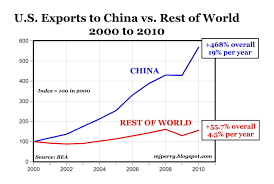

U.S. reliance on China illustrates the expectation that U.S.-Sino economic relations may remain relatively unchanged. U.S. exports to China far outweigh Chinese imports to the U.S., and Chinese investment in U.S. firms has grown 300% since 2015. Now that Trump is in office, his threats to this relationship have dwindled, for he has recognized that conflicts arising over a certain issue will do more harm than good in a partnership that must mature in order to meet both nation’s interests.

The Prof: This graph is very odd, in part because it ignores that for China the base in 2000 was very low.

This is not to say China is still not an economic threat to many areas of the U.S. economy, and a number of important steps must be made in order to assure the U.S.’s role is not diminished in this relationship. China’s focus has shifted away from low-tech and clothing manufacturing to be shipped to the U.S. Instead, Chinese firms are focusing on developing technology that they can label as Chinese products, directly competing with U.S. firms. One example of this shift is China’s intentions to be a global force in semiconductor manufacturing, with two of the largest firms operating heavily in China already (Samsung, TSMC). Further restrictions on foreign investment and trade have made it difficult for U.S. investment in China as well, threatening firms that must take advantage of Chinese GDP and income growth in order to remain profitable in those regions.

Thus, the question remains: how does the U.S. respond to Chinese growth and investment regulations without threatening their symbiotic relationship? Trump’s public stance is to back away from the relationship, imposing trade tariffs and export restrictions that may do the opposite of what he intends, sparking a trade war that will negatively effect both nations. A more tactical approach may be necessary. Jacob Parker of the U.S.-China Business Council suggests regulations that don’t specifically target China, but put pressure on Chinese trade. A more direct approach would be to reciprocate Bejing’s current trade and investment restrictions, but could result in backlash and potentially further restrictions. Whether by direct contention with Chinese business or not, Washington will need to carefully carry out trade policies with China over the next 4 years in order to assure both nations’ success through their long-standing symbiotic relationship made up of mostly similar economic goals.

Sources:

10 Comments

If not by the practice of sanctions, how will the US compete with China if they begin to produce comparable/superior products? Although any kind of antagonistic relationship is unhealthy to foreign relations, how else is the US expected to compete and be absolutely superior?

One thing to keep in mind is the absence in China of a substantial financial/service sector that would be able to compete with the Western world on a global scale (as it stands right now). Much of Chinese business practices do not mesh well with Western norms, so it remains to be seen how well regular Chinese companies will be able to play with the rest of the world when it comes to globalization.

One area that the US needs to focus on in competing with China is human capital in science and technology. The Chinese place a heavy emphasis on the education of its population and drives them specifically towards STEM oriented careers as it tries to evolve into a more service based, high-skilled economy. Furthermore, China has a brain drain on the US in that they send a lot of their top students to study at the prestigious US universities but have them return home to China for their careers. Meanwhile, the US is not reaching a high enough level of students in the STEM areas. The government needs to find a way to attract young Americans to these fields if we want to compete and innovate at the same level as China going forward.

If you visit top companies in the US, you’ll find plenty of Chinese STEM people with M.Engineering and the like who have stayed here. Ditto people from other countries, South Asia of course but even Europe. I don’t offhand know of studies as it’s not a question I’ve looked at, but my suspicion is that the US does a good job of retaining the better students. Whether that will continue to be feasible under Trump is however an issue.

This is why I’m not terribly worried about this relationship falling apart in the near future. As of now, I would be surprised if foreign students studying here has a huge negative effect on U.S. students, and as you said, we end up retaining a lot of them. However, if the U.S. continues to lag behind others in education, we could see this beginning to have an effect as the trend of foreign students studying here continues to rise.

Currently, the U.S. does not have a bilateral investment treaty (BIT) with China. Although BIT negotiations have been going on no agreement has occurred, primarily because of failure of reciprocity. Because while in the U.S. investments by foreigners are treated the same as investments by domestic firms, except for a few sectors specifically excluded from the terms of the treaty (“the negative list”), China has not come forth with something that is acceptable to or matches reciprocity with the U.S. The U.S. rarely limits foreign ownership to a certain percentage of an investment, as China does across many sectors. To answer your question: how should the U.S. respond to Chinese growth and investment regulations without threatening their symbiotic relationship? I believe the key lies in utilizing the high-level U.S.-China Strategic and Economic Dialogue (SED).

In recent administrations, the SED has been the structure used to discuss a broad range of economic issues between the two countries. The new Trump administration needs to decide whether they will continue with the SED (as the Bush and Obama administrations did). The cabinet-level led SED is highly valued by the Chinese, as it gives the nation legitimacy and “face”. Making a decision to continue it can be used as a ‘bargaining chip’ by the new Trump administration to achieve economic concessions. If the high-level SED dialogue was eliminated China would lose standing, and such an act is likely to threaten the symbiotic relationship between the two nations, triggering protectionist policies that may be detrimental to both nations’ economies. China may be afraid that the new administration will not extend the dialogue mechanism, so it would be shortsighted for the U.S. to eliminate the SED, and smart for the U.S. to use it as a tool, perhaps even leverage, to get economic concessions.

http://thediplomat.com/2016/07/assessing-the-us-china-strategic-and-economic-dialogue/

Read the China chapter in Smitka & Warrian! Restrictions on foreign ownership don’t necessarily work in China’s favor.

Yeah, It seems to me that the two countrys’ relationship is one that is too bit to fail. I see it as Trump bluffing with the general public, but he has to be too smart to not realize the economic importance between the two countries. I think Deedee’s comments on establishing a BIT between US and China will prove critical going forward. Maintaining the SED is important from a tactical and symbolic standpoint, and I hope for both country’s sake that the relationship will be a good one for the next decade.

1: Remember the core lessons of intl trade theory, that trade is not a zero-sum game and that it should never be looked at in a bilateral context. Sure, China exports a lot of iPhones (like, 100% of those sold outside China) but they don’t necessarily have much Chinese value added.

2: There are major intl security issues revolving around China, particularly in the islands to the west of the Philippines / north of Malaysia / east of Vietnam.

3: We will look at other analytic issues when we take up technology. In particular, what is it, can it in fact be transferred, etc.

4: Since I teach a course on the Chinese economy, I won’t add further comments. Do though look through the FRED database, for example the following page that will provide a better empirical context: https://fred.stlouisfed.org/categories/16

4a: One example from Econ 274: will China really continue growing rapidly? In that course we argue “NO”.

I’d like to know more about how much damage Trump could potentially do by trying to restructure trade deals with China to help the US in his eyes. The Chinese people are no doubt very prideful, and certain actions by Trump, like calling the President of Taiwan, have already been viewed with skepticism. However, I find it hard to see him destroying the relationship entirely. Trump must understand that numerous American consumers have benefited from being able to afford Chinese products that are often cheaper than American made counterparts, so maybe there is a middle ground in trade agreements that he seeks?

Comments are closed.