What is Steel? Globally, steel can be found in a variety of products and structures – from personal vehicles to the Burj Khalifa: the world’s largest skyscraper. But what is steel, and why is it so important? Steel is an alloy, meaning that it is made by combining iron with another element, usually (but not always) carbon. This alloy can be up to 1,000 times stronger than iron, making steel an extremely useful and sturdy building material (ScienceKids).

Though steel’s roots can be traced back to early human civilizations (Warrian, 11-2), it was not until the 19th century that Sir Henry Bessemer’s new process enabled the inexpensive production of mass produced steel. Once Bessemer’s process hit the market, steel production skyrocketed, setting the stage for continuous innovation in the industry. Today, two distinct processes make up the bulk of worldwide steel production: the Basic Oxygen Furnace process and the Electric Arc Furnace process (MSU).

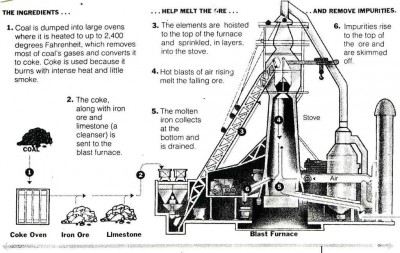

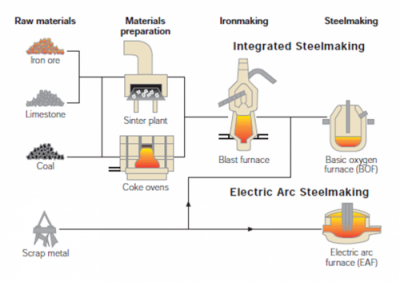

The Basic Oxygen Furnace The Basic Oxygen Furnace process, or BOF, makes steel using raw material inputs. This process rose directly out of the Bessemer process, and can be traced as the Linz-Donawitz process brought to market in the 1950s (Warrian). Here is a description of the BOF process (MSU):

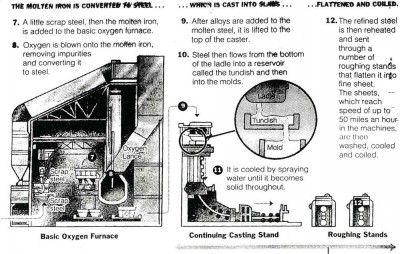

The Electric Arc Furnace The Electric Arc Furnace, or EAF, is an even more modern method of steel production. While the common inputs for BOF steelmaking are iron ore and coal, the EAF furnace operates using scrap steel – steel already produced and ready to be recycled. Nucor, America’s largest steel producer, has made its fortune by popularizing the EAF process at a time when scrap steel making became more effective than the BOF processes of the very integrated firms in the late 20th century (Warrian, 60-2). The diagram below describes the EAF process (A.C.P S.r.l.):

How do the Two Processes Stack Up? Although the BOF and EAF processes both produce steel as the end product, the varying means to this end between the two processes give each certain economic advantages and disadvantages. The main area of discussion centers around the supply side and the raw materials going into steelmaking. For BOF firms, producing steel requires sourcing a variety of raw materials, namely iron, coal, and limestone (MSU). Due to the necessity of securing these raw materials, early large scale steel firms like U.S. Steel (once the largest in the United States) found it economically viable to vertically integrate its production process backwards into coal and iron mining. Of course, these firms also controlled the necessary railroads, allowing for cheap sourcing of steel inputs (Warrian 27-32).

On the other side, EAF steelmakers have a much simpler input process: EAF furnaces only require scrap steel as the major input. As long as scrap steel remains plentiful in the market, these firms have easy and cheap access to the required raw material. As seen to the right, the supply sides of the BOF and EAF processes are very different (SteelConstruction).

On the other side, EAF steelmakers have a much simpler input process: EAF furnaces only require scrap steel as the major input. As long as scrap steel remains plentiful in the market, these firms have easy and cheap access to the required raw material. As seen to the right, the supply sides of the BOF and EAF processes are very different (SteelConstruction).

To contextualize these two differing supplies together, raw materials make up 50% of BOF cost and 75% of EAF cost, with the difference between the costs of these inputs determining which is more expensive. However, in the long run, these cost differences even out (WikiInvest) – so what is the primary tradeoff between setting up a BOF mill and an EAF mill? The answer lies in capital costs. For a BOF firm, the average cost per ton of capacity is $1,100, while the cost for an EAF minimill per ton of capacity is only $300. The barrier for entry is thus lower for EAF firms, which can in part explain the rise of such “minimills” over the last half of the 20th century and into the 21st (WikiInvest).

Conclusions With Nucor overtaking U.S. Steel in the American market, it is evident that the industry is facing a period of change. Certainly, the steel industry will be one to watch as the Chinese economy continues to slow down and the industry again becomes mature with numerous players in the EAF game. But despite firms like Nucor’s success, BOF steelmaking still accounts for 71% of total global steel production, with EAF production only accounting for 28% (the last 1% is open-hearth steel production) (WikiInvest). Given BOF’s large market share, will the industry continue to be susceptible to broad changes like that brought upon by vertical integration at the turn of the 19th and 20th centuries and the EAF development in the late 20th? Or, will changes in input prices finally move the industry in one direction (EAF) or the other (BOF)?

Sources:

http://www.wikinvest.com/wiki/Steelmaking

http://www.sciencekids.co.nz/sciencefacts/metals/iron.html

http://geo.msu.edu/extra/geogmich/steel_mill.html

http://www.steelconstruction.info/Recycling_and_reuse

http://www.olifer.com/en/steelmaking.php

Warrian, Peter. A Profile of the Steel Industry: Global Reinvention for a New Economy. New York City: Business Expert Press LLC, 2012.

10 Comments

The Chinese and Indian markets have increased steel production exponentially in the last two decades rivaling and over taking the old steel centers of the US and Euro zone. Trade economist believe a new “factory” trade markets are emerging and steel is the engine driving these factories. “Factories” are regions of the world that have created trade partnerships to more easily obtain and sell steel in the region. The major factories are the US, Euro Zone, and now the South East Asian factory with China, India, and Australia leading the way. The global steel market is becoming more and more regionalized, and as the US steel market changes, steel producers must become aware of these regional steel markets.

Scheuplein, Christop. 2010. “Vertical Integration And Macroeconomic Growth: The Case Of The Steel Industry” Erdkune Vol. 64 No. 4 pp. 327-341

Interesting point. However, this seems to be a conflicting theory with current ideas regarding globalization of industries. As the steel industry becomes more and more regionalized will competing firms essentially be U.S. Steel vs. Asia Steel? Will this give comparative advantages to countries with raw materials in their own country, and will it limit the ability of countries lacking these resources to produce in a market that is closed off with regional firms?

By Andrew Donchez

This is an especially interesting and relevant blog post for today. This Monday, iron ore prices surged by a record 17%. Similar to other commodities, iron ore prices have been depressed by decreases in Chinese demand. This 17% surge, however, may reflect optimism towards the stabilizing Chinese economy. In regards to steel production, it will be interesting to track how iron ore prices affect the market shares of companies using BOF versus EAF production techniques. From your blog post, it seems as though BOF production requires a greater input of raw materials (iron ore). These companies may have benefitted from depressed iron ore prices, but it is uncertain how long those low prices will last. If iron ore demand rises and the prices go up, EAF production companies may prosper.

So in what time periods have scrap prices been high so that EAF steel is not profitable? For what products is EAF technically appropriate? are there products that EAF cannot produce?

I think that it is important to consider that EAF is very dependent upon the current price of steel. This dependency may potentially result in volatility, which despite the lower cost of entry into the EAF steel industry may not be worth the potential risk of being dependent upon steel scraps. The dependency on steel scraps is especially concerning since these scraps originate from BOF firms, which compete with EAF firms directly.

You make a good point, Kelly. But, couldn’t we assume that the price of scrap steel and new steel vary proportionally. After all, one is only considered less valuable than the other because of use and wear. I would argue that having scrap steel as the major input actually provides a benefit to steel producing firms using the EAF method. While the price of coal, iron, and other inputs may vary independent of the steel market, the price of scrap steel will always be less than the value of new steel.

Well, scrap is a function of how many cars get recycled and how many ships get recycled (done in India among other places). Roads and buildings last a long time – it may be 70 years before the rebar in China’s new expressway system gets torn up. Ditto skyscrapers – the Empire State Building is 80+ years old. The Flatiron Building, an architectural masterpiece at 23rd and 5th/Broadway in Manhattan, is to my (limited) knowledge the first steel-skeleton skyscraper, at 22 floors. It was completed in 1902 so is 114 years old.

The EAF process is simpler in regards to input and production, but it does not come without its limitations. The article mentioned that the BOF process still has a dominant market share, but most of this stems from what is being demanded by consumers. High quality steels cannot be produced by recycling scrap metal, so EAF can’t even touch this portion of the market share.

Further, if you consolidate yourself to a singular input, you open yourself up to the risks of fluctuating prices of that input. If more players move into the EAF market as one commenter suggested, the demand for scrap steel will rise, and profits will be cut into.

As Warrian emphasizes, EAF is a low-cost, low-margin business. Firms like ArcelorMittal emphasize high-value-added, high-tech, lower-volume business. If successful, it will leave them – or at least that portion of their business – immune to price swings though not necessarily volume (e.g., automotive steel depends on final sales, over which steel firms have no control).

Comments are closed.