In its early years, Amazon began as an online bookstore, but over its past two decades, the company has rapidly expanded into a becoming a household name. Amazon has now broken into many different markets by selling music, movies, electronics, and even household goods on its website. The company is known for having “Earth’s Biggest Selection” of products available through its collection of websites that utilize a cost leadership strategy to stay ahead in the market.

According to a report from July 2015, Amazon only made $92 million for the previous quarter’s profit. When comparing this margin to other tech giants like Google, which netted $3.93 billion that quarter, or even its inferior competitor eBay, which made $682 million in the same quarter, Amazon simply does not measure up. How can the company be expanding so rapidly with a net income so low?

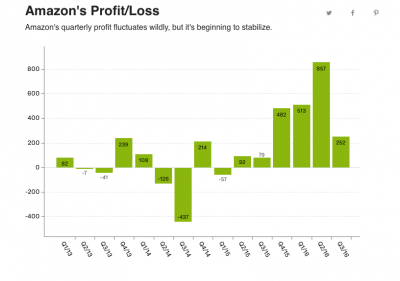

The secret to Amazon’s success can be dedicated to its unmatched business strategy. Throughout its existence, Amazon has been practicing a strategy called “purposeful investment” where although earnings are significant and large, the company puts most of its revenues back into the business to keep expanding. Although the company has only recently begun posting consistent profits (see graph 2), it has still been able to expand because of their continued large investments in research and development (see graph 3). These large investments help the company make the most educated and innovative business decisions and allow for major expansion.

As a result of their investment in research, the company has been able to provide several benefits that set them apart from competitors. Some of the specific measures taken include: steep discounts for is regular members through Amazon Prime (The $99-per-year Prime unlimited shipping membership has proven a big driver of online sales), ensuring timely and even express delivery and at times, waiving off shipping charges, and conveniently selling a variety of products in one place to fulfill all of their consumer’s needs. The company works to maintain maximum utility and efficiency as well as strives to make the customer experience as seamless and as smooth as possible.

Some analysts do not believe that Amazon can continue its heavy purposeful investment and maintain sufficient profits to keep investing, but even as the company begins to generate more consistent quarterly profits, the company’s CEO Jeff Bezos isn’t backing down from the investment strategy. Constant investment is crucial for a business like Amazon because if its innovation were to fall behind, the company could be overtaken by competitors in its many different fields. Therefore, in order for the company to continue its successful tract, it must keep up the heavy investment.

Luckily for Amazon, it can afford to continue investing large amounts of money into research and development because the markets it is targeting still have plenty of room to grow. The company has begun creating a larger geographic footprint by entering the overseas markets of Mexico and India. The company has also already seen major growth in Amazon Prime membership in Europe and Japan. Not only will Amazon expand its scope, but the dominance will also continue well into the future for Amazon as its taps into new product and service categories. By working to implement same day delivery, Amazon hopes to be able to revolutionize the grocery business, a category that has yet to successfully translate to the internet. With continued large investment into research and development, it seems as though the sky is the limit for Amazon.

Sources

https://news.thestreet.com/independent/story/13661539/3/here-s-where-amazon-is-investing-next.html

(graph 1)

http://www.theverge.com/2016/7/28/12313526/amazon-q2-2016-earnings-report-aws-cloud-profit (graph 2)

17 Comments

Has the company or CEO made a statement concerning when they plan on abandoning their current business strategy? As you explained above, the company has been losing money, and obviously they cannot continue this strategy indefinitely. At what point is it no longer beneficial for the company to continue its current strategy?

As Professor Smitka, mentioned in class, a large portion of Amazon’s funding came from the enormously high valuation it had when it went public. It still maintains this ridiculously high level. Although it has almost a $400 billion market cap, with basically no earnings its Price to Earnings ratio (P/E) is through the roof at 191. By comparison, the P/E of the S&P 500 is 24. Amazon boasts this extremely high valuation due to its clear potential but how long will investors be willing to wait for profits to emerge before we start to see downward pressure on the stock price.

Do you think their market cap has alot to do with the valuation that the banks set it at? What happens if people stopped buying their stock? They have been really successfull in part because they charge at such low profit margins. I am just skeptical of their whole valuation, and I feel like this is not a company that would apply under the fundamentals of value investing. Maybe I am wrong. But ultimately, no doubt their investments in R & D have contributed significantly to their growth.

One Amazon was publicly traded investment banks were done, they’d collected their fees. No ability to influence price.

One thing to take into consideration when looking at Amazon’s future success are its challengers from China. Companies such as Taobao and Alibaba have already begun muscling Amazon out of Asia, with Bezos attempting to imitate some of their noteworthy innovations here in the United States. With Alibaba/Taobao’s margins as high as they are (especially when compared to Amazon), Chinese companies like these are more than capable of facing endless costs in order to ensure a monopoly over whatever consumer market they have their eyes on.

Examples of imitation of Asian innovations?

The failure of Amazon to take off in China has to do with its inability to adapt their “one-size fits all” business model to local preferences and tastes. Amazon’s Chinese website had the same features as its standard website, where users could view seller reviews. However, Chinese consumers are distinctly different from American consumers as they wanted the opportunity to talk to the seller, form relationships (guanxi) with the seller, and haggle. Amazon failed to meet this demand, while Alibaba understood Chinese consumers, and therefore incorporated chats feature into their product: Taobao allowing for C2C e-commerce, and Tmall allowing for B2C transactions. Such features further encouraged competition amongst businesses, and therefore was compatible with the more price-sensitive Chinese market. As such, Alibaba controls 80% of market share in China, as opposed to Amazon’s 2%.

However, where in China Amazon had established its American practices and failed to gain much market share, in India, Amazon has learned to localize and therefore has been much more successful. To adopt to India’s cash-heavy economy, Amazon introduced cash on delivery services. Furthermore, the company introduced local initiatives like the “Chai Cart”, where Amazon executives met small traders over tea, and “Seller University”, where educational programs were offered to small time vendors to teach them how to get online and grow their business.

So Amazon learns from their failures! See what the Chinese are doing, approach India with a localization mindset. Many companies (or executive teams) lack this ability.

What is Amazon’s underlying business model? Do they have high fixed costs? If so then they will initially lose (lots of) money, but when/if sales grow they will earn lots of money. And the when/if question has largely been answered. Earnings in 2013 and 2014 were minimal. They earned $2 billion in operating income 2015. They announce earnings Feb 2nd (tomorrow); I should assign an update!

Now that they have market share, will they maintain all the Prime benefits? Some add-ons have already been deleted (free movies, free ebooks). They can incrementally reduce Prime free shipping without it even being obvious, dropping it for non-Amazon sellers even if things actually are warehoused by Amazon. It would be very hard for customers to spot. That would boost profits a lot.

What a lot of people don’t realize about Amazon is how big of a role their web services play. It has consistently generated a ton of profit compared to their retail outlet. The amount of data and web services that Amazon can offer is unmatched and I don’t see another company being able to overtake them in that sector. While it is certainly important for their retail outlet to find a way to actually become profitable, remember that they have a whole side of their business that is doing extremely well and can keep it afloat for the foreseeable future.

You bring up a good point here. Amazon Web Services is an enormous generator of revenue for the company. This sector already has a notable group of clients, and it also attributes greatly the estimated value of the company. In fact, I would imagine that a lot of investors are drawn to Amazon simply because of the potential of their web services. Amazon Web Services is generating sizable revenue, even if it is not in the same realm as their costs, but I think that they can develop this area of the company into one that makes it profitable.

What share of revenue? profits?

According to this link, AWS was responsible for only 7.4% of total revenue in 2015. Although, its smallest segment, AWS is by far Amazon’s strongest given it 23.6% operating margin compared to 4.3% and -.3% for its other segments respectively.

http://revenuesandprofits.com/amazon-revenues-profits-analysis-2015/

I find it fascinating that no other major company can possess a similar business strategy and be considered “successful.” It’s also rare in businesses that successful and profitable are not mutually inclusive, but as mentioned earlier a lot has to do with their shockingly high valuation. One certainly must wonder if this is sustainable or if they will have to shift to a more profit-centric model of delivering their services similar to what Alibaba does in the Chinese market.

Is this intrinsically a one-firm industry? That begs many questions, including what the industry is, who their competitors are, and whether firms like Alibaba/Taobao (China) or Rakuten (Japan) won’t find barriers to entry.

So, what is Amazon’s business?

Amazon’s ability to stay ahead of the field, in addition entering new markets has no doubt led to their success. When I think of their investment into R&D and the constant evolution occurring, Amazon’s grocery stores immediately come to mind. In these stores, Amazon has sought to eliminate what every grocery store customer loathes, checkout lines. Thus, the store has employed “a combination of computer vision and deep learning technologies” that track what items customers wish to purchase. One can only imagine the money Amazon spent in order to develop such technologies. However, now that Amazon has this technology, their grocery stores are one of a kind, unlike any other store in the world.

Perhaps this is Amazon’s ultimate strategy. By separating themselves from others in industry, whatever industry that may be, as the company’s interests are certainly diverse in nature, they will be able to dominate markets. This is starting to happen already as Amazon’s long-term growth has been trending upward, according to the graph provided. Thus, their gamble to invest heavily in R&D, driving down profits, may in fact be causing current growth and long-term growth moving forward.

http://money.cnn.com/2016/12/05/technology/amazon-go-store/

Looking back on the comments, some of what is labeled “R&D” is in my mind marketing expenses. I have not looked at Amazon’s financial statements to see what distinctions they report.

Comments are closed.